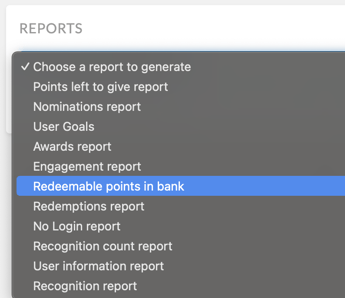

Redeemable Points in Bank Report

This article goes over how to navigate and interpret the Redeemable Points in Bank report.

For Platform Administrators:

This article is intended for Bucketlist platform administrators. If you are an employee or end-user, some features or settings described here may not be available to you.

Understanding the Redeemable Points in Bank Report

This report shows the total redeemable points in the system, which is important for understanding your potential financial liability—especially in the case of employee churn or cash-out scenarios.

Important Note: The raw report includes both active and deleted users.

To calculate your actual total for active users, follow these steps:

- Open the CSV file in your preferred spreadsheet tool.

- Apply a filter to the full sheet.

- Locate the “TRUE” column (this may be labeled as “Is Active” or similar).

- Filter out deleted/inactive users by deselecting all values except “TRUE”.

- Scroll to the Redeemable Points column and sum the values for only active users.

You’ll now see the total redeemable points for active users, e.g. 10,000 points.

Converting Points to Dollar Value

To estimate your financial liability or budget exposure:

- Identify your organization’s point-to-dollar ratio (this varies):

-

- Common examples:

-

-

- 1 point = $0.10

- 1 point = $0.50

- 1 point = $1.00

-

2. Multiply the total active users’ points by your set conversion rate.

Example:

If you have 20,000 points across active users and your program values 1 point = $0.50:

If you have 20,000 points across active users and your program values 1 point = $0.50:

20,000 x $0.50 = $10,000 potential liability

Understanding your redeemable points in bank helps with:

- Budget planning for rewards

- Assessing liability in churn scenarios

- Forecasting redemption behavior

- Making informed decisions about top-up budgets or reward strategies

We recommend reviewing this report monthly or quarterly, depending on your program’s reward frequency and redemption activity.

-4.png?width=300&height=97&name=bucketlist-full-logo%20(2)-4.png)